Will Low Global Equity Investment Director

12 Jan 2021

2021 Global Equity Outlook

Virus news remains dark but light at end of COVID-19 tunnel

As the calendar turns and a new year set to begin, market commentators are once again dusting off their crystal balls. None of us, however, predicted 2020 and the inevitable hangover from 2020 makes the forecasting error associated with 2021 even higher.

Countless “Year Ahead” pieces of research routinely predict that 2021 will be the opposite of the one that just passed. In many ways, we certainly hope that this will be the case. Hopefully the various vaccines either already approved or pending approval will be as effective against any new mutations of the virus as they have been in the clinical trials carried out to date.

Certainly, there are grounds for optimism for the year ahead. After a year of forced abstinence, we hope that some of the experiences that we used to regard as routine will now be available for us to enjoy once again. International travel will be near the front of the queue for many of us. In a business investment sense, companies will likely feel optimistic enough to rebuild inventories that they ran down as manufacturing capacity was shuttered during lockdowns.

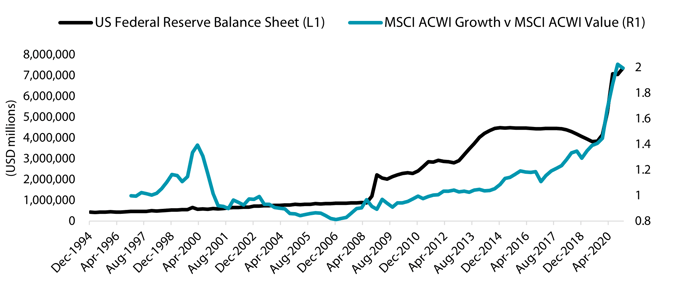

Once the sugar rush of returned freedom has passed, however, will things have changed much, relative to 2019? The Federal Reserve (and other central banks) are doing their bit, as ever (see chart below) but will the spurt of economic growth be strong enough to create a lasting inflationary impulse (supporting a sustainable rotation into “value” parts of the market) or will the immovable objects that are western world demographics and substantial debt burdens mean that 2022 and beyond look much like 2019? If so, investors will likely still be faced with relatively anaemic economic growth and favour those companies most able to deliver strong revenue and profit growth, borne out of sustained innovation

Source: Bloomberg, as at 22 December 2020.

We continue to spend the vast majority of our time on company research and there are doubtless other observers better placed to predict which path that the market will go down, but it seems more likely to us that the future will look much like the pre-COVID-19 recent past. For instance, central banks have become increasingly politicised in recent years. At the same time, many national governments are more indebted than ever, having rushed through huge wage support programmes—designed to postpone a severe economic reckoning as a result of the lockdowns that they imposed. Against this backdrop, it looks unlikely that interest rates will be allowed to rise meaningfully,

and this is a very real headwind for banking stocks in particular.

Our portfolio continues to own both cyclical and growth stocks, as we continue to find “Future Quality” characteristics in both camps. Recent months have seen us adding to some of those cyclicals and trimming some of our growth winners, where valuations had become extended. Most observers (including us) believe that the next few months could see a continued narrowing of the premium paid for growth stocks. Where we believe that relative valuations have moved too far, too fast, we will not be afraid to act accordingly. This could easily see us adding back to our growth stocks, but only where we believe that the business in question is continuing to improve and future cash returns on investment are likely higher as a result. In many cases, these improvements will be underpinned by products and services that help society address pressing long-term issues. Challenges such as delivering affordable healthcare or protecting our climate will demand sustained action whether growth is better than value or vice versa.

In conclusion, it is an enormous relief to all of us that the world’s scientists may be about to deliver us respite from the loss and stress caused by this pandemic. For millions of people 2020 was clearly an extremely difficult year and we hope that 2021 brings better times for them. From an investment perspective, this transition from hopeless to hopeful is driving a period of reassessment. At times like this, it is easy to lose your bearings and spend all your time attempting to foresee the macroeconomic future—letting that view dictate the new investment ideas that you bring forward. This is a bit like using a telescope the wrong way round in our view. Instead, we continue to spend all our time focusing on the stock specific Future Quality attributes of the companies that we invest in for our clients.

Important Information: This document is prepared by Nikko Asset Management Co., Ltd. and/or its affiliates (Nikko AM) and is for distribution only under such circumstances as may be permitted by applicable laws. This document does not constitute personal investment advice or a personal recommendation and it does not consider in any way the objectives, financial situation or needs of any recipients. All recipients are recommended to consult with their independent tax, financial and legal advisers prior to any investment.

This document is for information purposes only and is not intended to be an offer, or a solicitation of an offer, to buy or sell any investments or participate in any trading strategy. Moreover, the information in this document will not affect Nikko AM’s investment strategy in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Nikko AM makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this document. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. This document should not be regarded by recipients as a substitute for the exercise of their own judgment. Opinions stated in this document may change without notice.

New Zealand: Nikko Asset Management New Zealand Limited (Company No. 606057, FSP22562) is the licensed Investment Manager of Nikko AM NZ Investment Scheme, Nikko AM NZ Wholesale Investment Scheme and the Nikko AM KiwiSaver Scheme. This material has been prepared without taking into account a potential investor’s objectives, financial situation or needs and is not intended to constitute personal financial advice, and must not be relied on as such. Recipients of this material may wish to consult a Financial Advice Provider (FAP) and the relevant Product Disclosure Statement or Fund Fact Sheet (available on our website: www.nikkoam.co.nz).

.jpg?width=754&name=iStock-1069549614%20(1).jpg)

.png?width=362&name=Ferg%20info%20centre%20(1).png)