You’ve probably seen ads for investment apps that promise to turn you into a share-trading guru overnight with an outlay of a few cents. The rise of DIY investing apps is bringing share investing to the masses – but before you jump in boots and all, it’s wise to research the different investment approaches.

In this page we talk about the merits of DIY investing in shares compared to managed funds, what robo-advice is (and is not) and why (regardless of your chosen approach) it’s important to understand your own tolerance for risk.

With actively managed funds you get the benefit of a fund manager's expertise and the flexibility to invest across various investment classes.

Perhaps you’ve heard your friends talking about their sophisticated-sounding investment portfolios. Or maybe they’re ‘dabbling’ with online share platforms and are raving about the increases they’re seeing. You want to be part of the conversation. But perhaps you don’t feel entirely comfortable with investing in financial markets, with all the complications, jargon ...and what about the risks?

Do you have the time, inclination and knowledge to dive into investing? And what’s the difference between common types of investing like shares and funds? Let’s clear that up first...

Buying shares (a.k.a. stocks or equities) can be complicated and time consuming – requiring education about specific companies and share markets. The potential risks and rewards can both be high. You’ll also need to consider whether to invest in companies that offer regular dividends to supplement your income, or choose those with higher prospective growth, or a mix of both.

Then there’s the decision whether to use a broker or an online share platform, both of which charge fees per transaction. You may also end up with new tax obligations that you’ll need to factor into your overall financial situation.

If you like researching investments or have specific things you wish to invest in and can tolerate the potential ups and downs this could be the right option for you.

Investing in managed funds means your money is pooled with other investors and you own a proportion of the total fund, as units in that fund. With an actively managed fund, a fund manager (or team of funds managers) monitors your investments, researches opportunities and selects how, where and when to invest, based on their knowledge of companies and markets.

With managed funds you still have control over the types of funds you want to invest in - which will satisfy your desire to be more active in your investment decisions. But at the same time, working with a fund manager means their skills are working to ensure you have a well-managed portfolio of assets, with less risk of buying or selling the wrong shares at the wrong time.

Investing in actively managed funds takes the 'guess-work' out of investing.

Perhaps you have a nest-egg ready to invest or maybe you expect to receive a windfall in the near future. Or perhaps you’re ready to start ‘chipping away’ at investing in small amounts each month.

Regardless of how much or how often you’re looking to invest, here are a few reasons for considering an actively managed fund in which to invest your future wealth:

A key benefit of professionally managed funds is that they let you access various investing opportunities that you may not otherwise be able to benefit from as an individual investor.

The variety of managed funds spanning asset classes means you can choose the one that fits your preferences – from high risk/high capital growth over the longer-term, to low risk options, which give you a slow but steady income.

Not only are fund managers experienced professionals, specialising in investing, they’re plugged in to detailed, current information, which helps them make timely, informed decisions on your behalf. They also have analysts that research companies and trends on a daily basis.

All investments carry risk, and those with high potential long-term returns may have higher short-term risks. Fund managers manage the risk of their fund so you don’t have to.

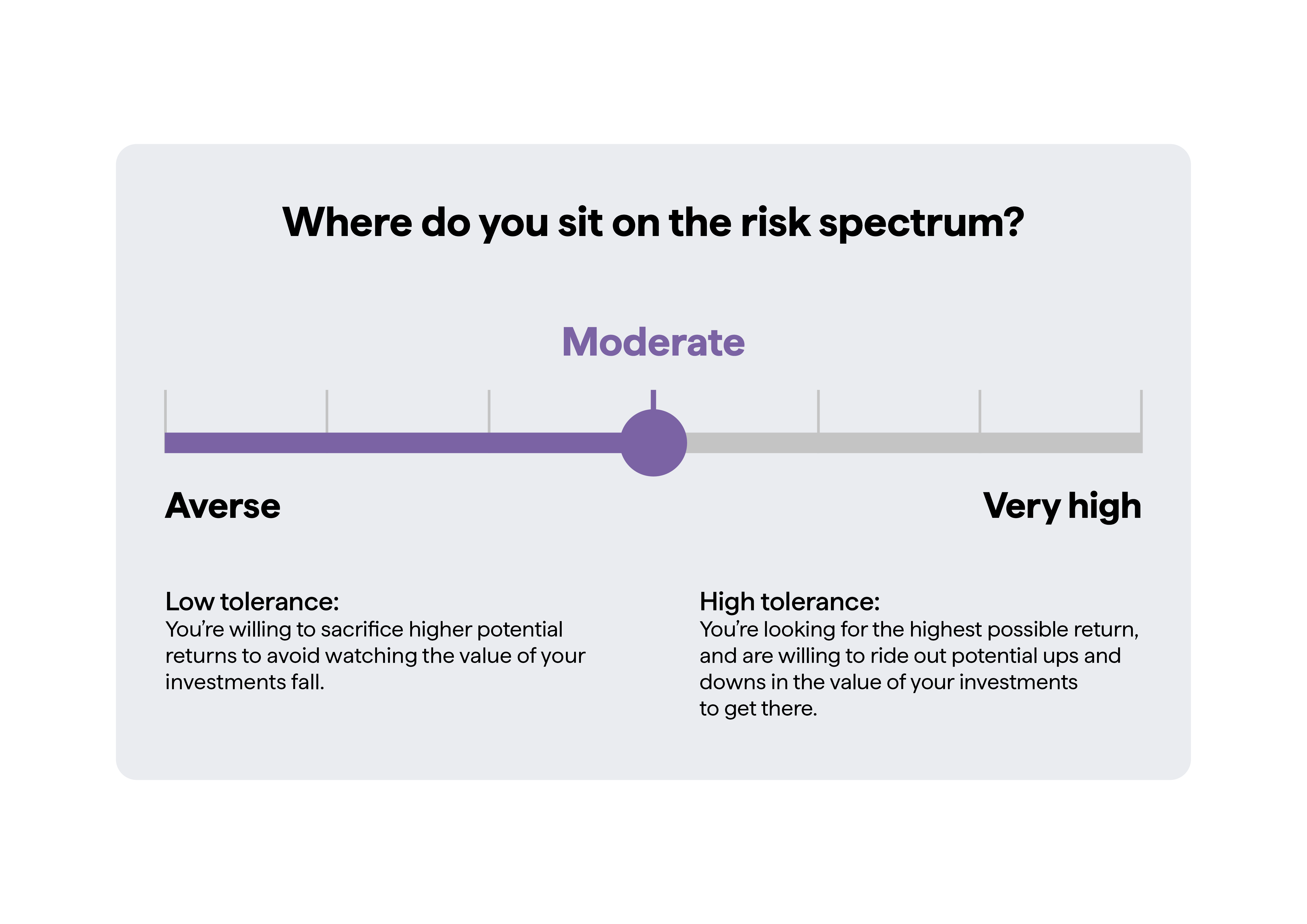

Regardless of what approach you take to investing, it’s vital to understand your risk profile or risk tolerance.

Risk is a trade-off between earning a higher return vs having less chance of losing money. Understanding how comfortable you are with potential losses will help you choose the types of funds with the most optimal asset allocation to suit your investing goals and timeframe.

When it comes to actually investing your hard earned cash, it’s the people behind GoalsGetter, our team of experienced fund managers located in New Zealand, who are actually making the investment decisions.

Today there are a plethora of online investment platforms available that empower everyday investors to not only ‘dabble’, but seriously invest. ‘Robo-advice’ is a term coined to describe these online platforms that essentially use digital algorithms to enable people to invest without having to interact with a human.

Robo-advice is provided by a programme that provides algorithm-driven investment recommendations based on limited inputs from an investor. For example, you might answer a quick quiz about your age, income, and appetite for risk – and the robo-advice tool would recommend a fund that reflects your situation.

The benefits are that these platforms lower the entry-barrier for every-day investors and make it easier for investors to go through the process of investing. However, not all ‘robo-advice’ tools are the same and if you have complex financial requirements, they do not replace the services than can be provided by financial advisers.

With GoalsGetter, the ‘robo-advice’ component is available to help educate investors about how different inputs such as age, timeframe and fund types can impact the projected value of your investment in the future. It quickly and easily helps you set goals and select the right types of funds to suit your goals and investor profile.

Today, building wealth through financial market investments is accessible to anyone with a few dollars to spare. As fun as it is to have a dabble with shares, when it’s time to get serious, it’s worth considering entrusting your money with professionals who spend their days analysing markets. Through easy to use robo-advice tools like GoalsGetter, you can still DIY your portfolio and feel in control of your investments in your own time. However, you can sleep at night knowing that decisions about your money are being made by experienced fund managers working actively on your behalf.